Long-term track record

Since its launch in 2007, 3i Infrastructure has built a portfolio that has provided significant income and consistent capital growth.

Our portfolio

Digitalisation

DNS:NET

Germany

Communications

Energy transition

ESVAGT

Denmark

Energy

Energy transition

Future Biogas

UK

Utilities

Digitalisation

FLAG

UK

Communications

Energy transition

Infinis

UK

Utilities

Demographic change

Ionisos

France

Social infrastructure

Energy transition

Joulz

Benelux

Energy

Renewing essential infrastructure

Oystercatcher

Singapore

Transport & logistics

Energy transition

SRL Traffic Systems

UK

Transport & logistics

Digitalisation

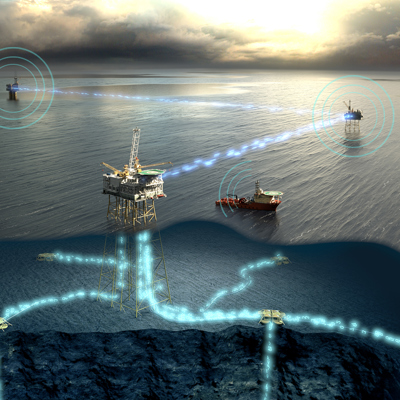

Tampnet

Norway

Communications

Energy transition

TCR

Benelux

Transport & logistics

Key portfolio facts (as at 30 September 2024)

Value of portfolio

Megatrends

Number of investments

Latest portfolio news